Haru Invest Review: Is Haru Invest safe? Features, Interest rates, Strategies and Risks (Updated June 2023)

Haru Invest is simple: Users deposit their crypto and watch it grow in the same cryptocurrency. Try it today.

Haru Invest does one thing: it increases your crypto holdings.

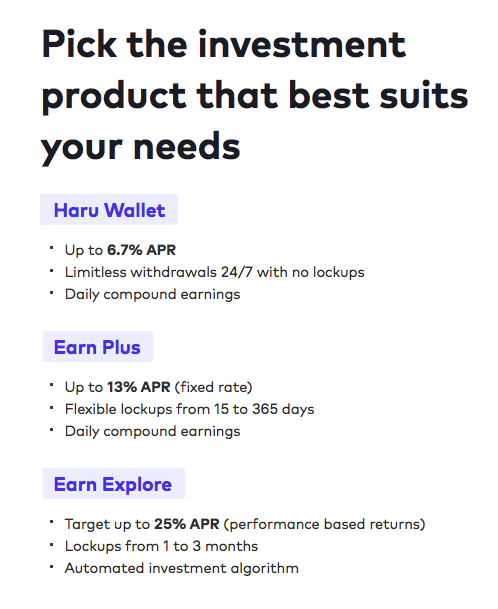

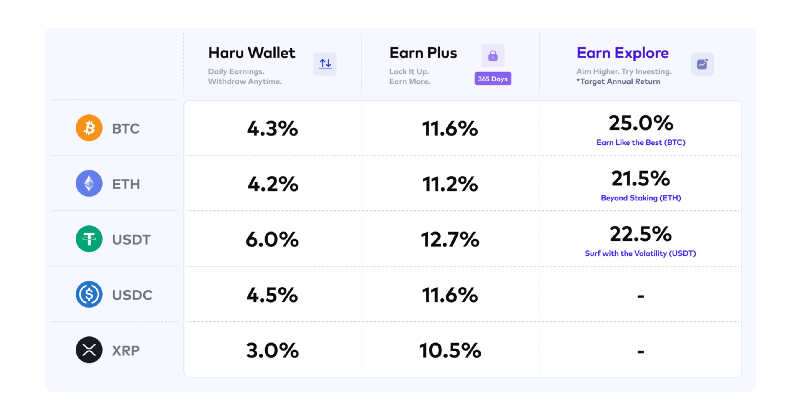

The firm is a pioneer in providing premium hedge fund experience to retail customers, by offering one of the highest yields on cryptocurrency assets across the industry (annually up to 25% on $BTC, up to 21.50% on $ETH and a maximum of 22.50% on $USDT)[1], together with flexible lockups (0–365 days, depending on your choice) that allow you to enjoy daily compound earnings as an investor.

With over 4 years of expertise in advanced algorithmic trading via low risk market neutral strategies, the firm focuses on increasing the amount of the cryptocurrency itself, regardless of prices or market directions.

Launched as a small finance startup in 2019 in 🇰🇷South Korea, it’s led by a group of experienced blockchain experts (see Block Crafters) whose revolutionary strategy to capitalize on market inefficiencies unique to the crypto futures market only has recently brought them to the forefronts of blockchain investment spotlights.

Table of contents:

- Introduction

- Numbers ( 2019 | 2020 | 2021 | 2022 | 2023 )

- Timeline ( 2019 | 2020 | 2021 | 2022 | 2023 )

- Company ( Origins | Block Crafters | Block Crafters Capital | HaruBank | Haru Invest | Offices )

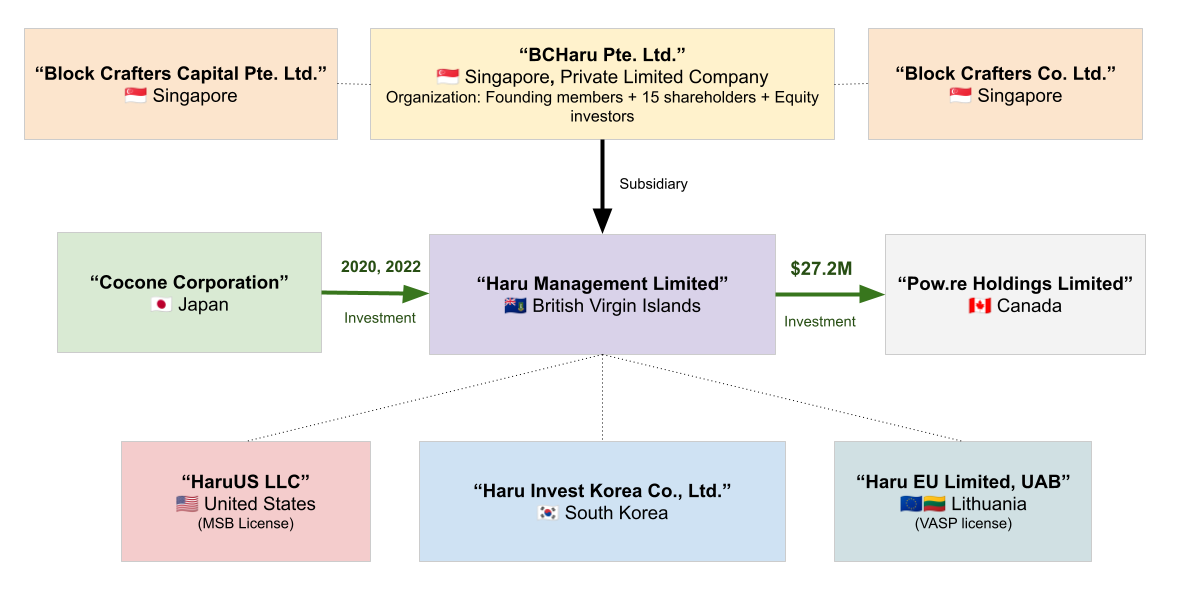

- Corporate structure ( Haru Invest Korea Co. | Haru Management Limited | Block Crafters Co. | Block Crafters Capital Pte. | BCHaru Pte. | HaruUS | Haru EU Limited UAB | Investments | Other territories )

- Regulatory compliance ( British Virgin Islands | United States of America | South Korea | Singapore | European Union | Auditing )

- Team ( Managers | CEO )

- Platforms ( Technological infrastructure )

- Assets supported ( New possible additions )

- Products ( Haru Wallet | Haru Earn Plus | Haru Earn Explore | Haru Freeze & Freeze Marketplace | Haru Switch )

- Miscellaneous features ( Transaction export | Price alerts | Luminary club )

- Strategies, Risk, Traders ( Strategies | Traders | Risks )

- Security and Trust ( Security measures | Legal compliance | Trading teams | Bank run protection | Liabilities )

- Next steps

- Conclusion

- Contacts

- Revision history

- References

Unlike competitors, Haru Invest does not lend out its deposits, rather than utilizing only for low-risk market-neutral strategies, which overall provide a higher income return compared to models relying on lending and borrowing.

With zero security and withdrawal incidents to date and an 85% customer retention rate, it strives to maximize the power of their crypto assets through secure and simple investing.

But should you entrust your personal crypto savings to Haru Invest during a time when much more eminent crypto behemoths such as FTX, Celsius and Three Arrows Capital have collapsed? Let’s see!

👉 Want to try Haru Invest? Use this link to start earning!

1. Introduction

‘Haru’ (하루) is a Korean word which means “day” in the Korean language.

Haru Invest aims to bring the premium strategies used by hedge funds and trading firms to regular retail investors in crypto. It serves as an alternative to yield farming and provides users with a custodial platform which generates profits by utilizing inefficiencies unique only to the mechanics of the crypto market. And no, the company does not[62] solely rely on arbitrage and the Kimchi premium effect in its operations, as we will see later!

While 2021 was the year when Bitcoin reached an all time high peak of 68,789 USD, in 2022 the market witnessed the digital currency of Satoshi Nakamoto crash to as low as 15,000 USD (as of December 2022). However, many predict that the price of Bitcoin will skyrocket again after the next Bitcoin halving which is estimated to happen around April 2024.

In the background of these tumultuous events, crypto investment platforms which offer returns on capital within the cryptocurrency industry have been gaining popularity, both for good and bad reasons.

The first group offered investors lucrative returns on their dormant cryptocurrencies during one of the most distressful times in finance, while others — such as Celsius and BlockFi — became infamous as it turned out they had exposures to poorly vested projects such as Terra LUNA or the FTX exchange.

Currently, Haru Invest is one of the few crypto asset management platforms which is still able to consistently offer competitive return rates to investors, with its flagship investment products reaching up to 25+% APY during the peak moments, while also holding respectable 10–12%+ APY returns during the darkest moments of the global crypto market.

These bold numbers obviously require us to tread carefully and dive deeply within the technical details of Haru Invest, raising many questions: How does the firm achieve these profits? Where it is based? How user funds are managed? Is product capital guaranteed? And much more…

Together we will investigate all these together, looking for the answers.

2. Numbers

2019

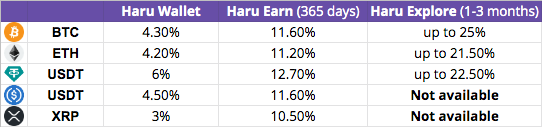

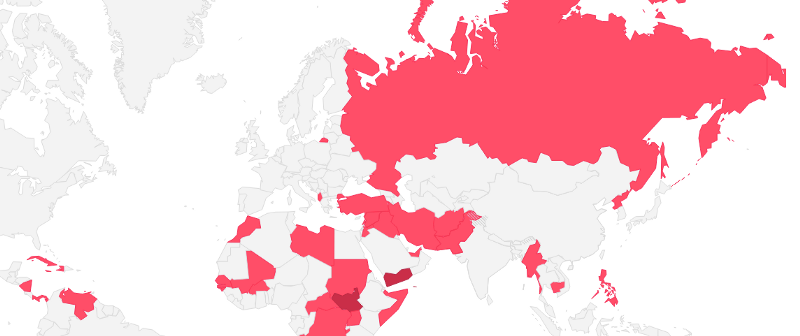

Starting with about 1000 investors in 2019[2](Editor’s note: Rough estimate), Haru Invest has processed more than $2 billions in total transaction volume across more than 140 countries, while paying out earnings over 4 million times and has never experienced a security breach, missed a earnings payout or failed a withdrawal to any of its users.

2020

In 2020, the subscribers amount grew 10 times (there were users from 25 different countries[74]) and the deposit volume increased by more than 450%, with a 40% increase in long-term lock-up users in comparison with 2019[67]. In February 2020, more than a half of the AUM portfolio was dominated by Bitcoin (BTC: 53.80%, USDT: 25.00%, ETH: 21.20%[72]), momentarily being overtaken by USDT in March 2020[79], then dropping to 40% by April (BTC: 40%, ETH: 35%, USDT: 17%, KRT: 8%[74]), and ultimately becoming nearly equalized with Ethereum at 36% as of May[75], but barely dominating again in July[76]. A clear preference of users to depositing Bitcoin the most and to opt for locked duration products is clearly visible during 2020[2][72][74][75]. Haru Invest has delivered earnings 465,000 times (Editor’s note: It could be possible this is the number as of February 2021[51], as August 2020 report indicates more than 200,000 payouts[84]) and processed total $31 million as of August[84], $46 million as of September[67], and $100 millions as of December 2020[85] in transactions* (Editor’s note: The listed total transaction data for the “first year” of $171 millions[67] published in multiple press releases — here¹, here² and here³ — during February 2021 is in conflict with volume reported on 14 September 2020 via the Medium blog of the company. Rather, this could be the latest transaction volume as of February 2021[51][67], since total volume in August 2020 was $31 millions[84]). As of August 2020, subscriber base grew by 992% and user deposits increased with 456%[84], and as of December 2020 the platform had more than 10,000 users from 30+ countries[85] (Editor’s note: It can be roughly reverse interpolated that in 2019 there were an estimate of ~1008 users[2]).

2021

The year 2021 was a strong one for Haru Invest (Editor’s note: Bitcoin saw a great bull run after the 2020 halving) with the total transaction volume starting at $171 million in February 2021[2][51], then increasing 27 times more than the previous year, reaching over $800 million (Editor’s note: mathematically estimated ~$29.62 million for 2020[2], or $46 millions as reported on 14 September 2020[67]). The products of Haru Invest paid out more than $2 million (as of February 2022)[2][3] in 995,476 separate earnings (Editor’s note: An average ~$2 per payout) to investors. Asset Under Management (AUM) grew 15x in comparison to last year, with investors from 45 countries[51] and 40% of them utilizing the flagship product Haru Explore[32].

2022

As of November 2022 Haru Invest can boast with more than 76 000 registered users[1] from 140+ countries[1], a total of $4.1 million earnings paid-out[1], and a cumulative of $2.11 billion[1](Editor’s note: Also confirmed by the CEO to be ~2 billion in July 2022[12]) in transaction volume processed[1]. Additionally, 87.50% of the members who did make a deposit continue to use the platform actively (the average lock-up period being more than 100 days with 95.60% of the assets secured as lock-up[4][11][29]), which might speaks of a high retention rate of users who did make deposits[2](Editor’s note: However, as noted by a Reddit user, these numbers identify only members who did make deposits and might be misleading, as no real data is provided for users who registered but didn’t make any deposits[2]). In July 2022 it was disclosed that current AUM is under $1 billion*[16] and has grown 12x[4] in comparison to 2021[12](Editor’s note: A theoretical speculation for the largest possible amount of AUM of Haru Invest might have had in July 2022 would suggest a maximum of $999 million, and in July 2021 the number would have been at most “only” $83.25 million, which would reveal an explosive growth. Additionally, as AUM growth is reported to be 15x for 2021, further a hypothetical maximum of $5.55 million for July 2020 can be roughly estimated. This means for 2 years the AUM could have grown ~180 times[2]).

2023

As of February 2023, Haru Invest has more than 80,000 registered users[4], who have received a total of a total of $9.8 million earnings paid-out[4](Editor’s note: The accuracy of this number is at doubt, as the same variable is listed as $4.1M for 2022[2]), 91.40% of assets being locked for an average of 142 days[4] and 85.10% of users who has made a deposit continuing to use the platform[4].

NOTE: More precise numbers cannot be fully disclosed by Haru Invest due to legal and regulatory reasons[12].

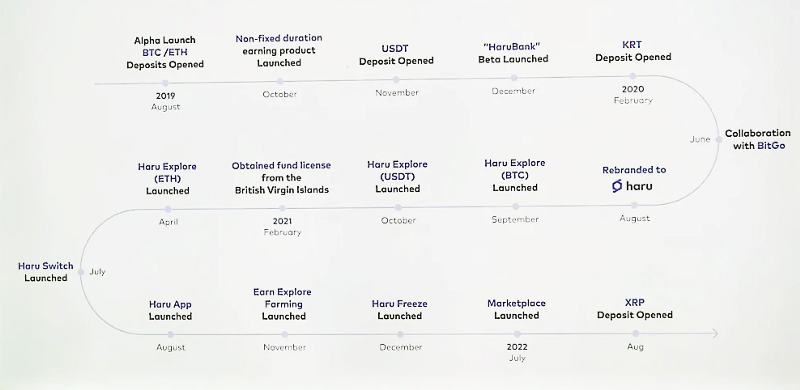

3. Timeline

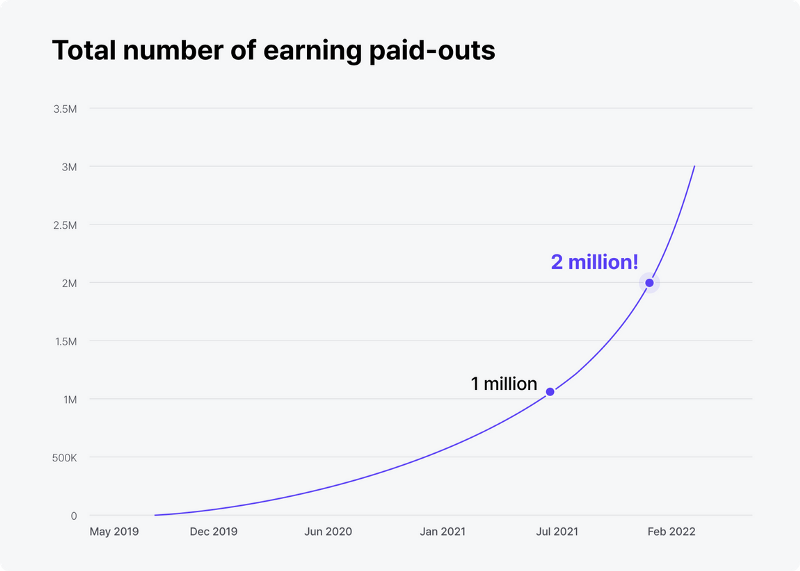

Below is a quick timeline of what Haru Invest has done so far[2][27]:

— — — — — — — — — — — — — 2019 — — — — — — — — — — —

[2019, September]: HaruBank is launched as an alpha test (or a service brand[85]) oftheir parent company, Block Crafters. Initially only BTC and ETH deposits are supported[29].

[2019, October]: Non-fixed duration earning product launched[29].

[2019, November]: USDT deposits added.

[2019, December]: Beta phase of HaruBank starts. Block Crafters Capital joins the group of the existing 6 global asset management partners[80].

— — — — — — — — — — — — — 2020 — — — — — — — — — — —

[2020, June]: HaruBank partners with BitGo[83] which becomes their crypto custodian. Moreover, a partnership with HashQuark is established.

[2020, August]: HaruBank changes its name to Haru Invest. Business model changed from “loan-deposit management” to “asset management”[63].

[2020, September]: Flagship strategy “Haru Explore” launched for BTC[63].

[2020, October]: USDT added to the “Haru Explore” yield strategy[65].

[2020, December]: Haru Invest reaches $100 million in total transaction volume

— — — — — — — — — — — — — 2021 — — — — — — — — — — —

[2021, February]: Obtained “Approved fund” license from the 🇻🇬British Virgin islands. Haru Invest has processed $171M total in transactions and 465,000 payouts during its last year[51].

[2021, April]: “Haru Explore” now supports ETH[89].

[2021, July]: Asset swapping product “Haru Switch” launched. US company for Haru Invest is registered[53].

[2021, August]: iOS and Android mobile applications launched.

[2021, November]: Liquidity farming option added to Haru Earn Explore. Haru Invest reaches total $1 Billion in transaction volume

[2021, December]: Haru Invest partners with Keith Haring for an NFT sale. Haru Freeze is launched[58]. “Farming Just Got Easier” added to Haru Explore[88].

— — — — — — — — — — — — — 2022 — — — — — — — — — — —

[2022, March]: Haru Invest offers a limited promotion with up to 17% APY in earnings guaranteed

[2022, June]: Haru Invest CEO, Hugo Lee, makes a presentation in one of the world’s largest crypto conferences, Consensus 2022[54] and first Reddit AMA is hosted directly by the CEO, Hugo Lee[12].

[2022, July]: Haru Invest reaches $2 billion in transaction volume. Haru Marketplace is launched[58].

[2022, August]: Haru Invest announces acquisition of Money Service Business License from U.S. FinCEN[55]. Ripple added as an asset.

[2022, September]: Haru Invest celebrates three years and Raises New $4M Funding At A $284 Million Valuation by Cocone Corporation[47]. Second AMA hosted on Reddit. Haru EU Limited UAB is registered in Lithuania[125].

[2022, October]: Haru Invest attends Token2049 event in Singapore

[2022, November]: Haru Invest adds support for USDC

— — — — — — — — — — — — — 2023 — — — — — — — — — — —

[2023, February]: Haru Invest makes an investment of $9M in Canadian crypto mining firm Pow.re[110]. Third Reddit AMA is hosted[112]. Tax reporting service CoinTracking is now integrated for users[126]. “Badges” achievement system added to “My Freezer”[2][112].

[2023, March]: Haru EU Limited UAB receives VASP authorization from Lithuania for operating in EU[122].

[2023, April]: Haru Mining with guaranteed principal is launched[113]. Haru Invest mobile application is redesigned and Haru Community and newsfeed are included as features[121]. AMA sessions start to be conducted inside the mobile application, instead of Reddit[2].

[2023, May]: Haru Invest allows mobile users to buy crypto with cash directly via Mercuryo[120]. Haru Invest Korea receives Information Security Management System (ISMS) Preliminary Certification[116]. Referral program is relaunched only for some countries from Latin America[115].

[2023, June]: Haru Invest attends Bitcoin 2023 conference[114]. One-time promotion of 50% APR is offered for a single lock-up of up to 300 USDT per account[119]. Round 2 of Haru Mining is announced[127]. Haru Invest abruptly pauses withdrawals and deposits[128].

4. Company

Origins: Haru Invest was a project of its parent, BlockCrafters

Founded in 🇰🇷South Korea and headquartered in 🇸🇬Singapore, Haru Invest began operations in 6 August 2019 under the name HaruBank with the mission to provide the premium experience of a personalized hedge fund to the growing retail crypto space.

Initially it was launched as a business unit (or a “service brand”[85]) of its parent company, Block Crafters (Editor’s note: Launched in May 2018 and formally incorporated in 🇸🇬Singapore in 2020[43], specializing in digital asset banking, crypto fund management, blockchain media services and providing acceleration program for startups[30]), but Haru Invest has been been operating as an independent subsidiary from it since the end of 2021[17].

Block Crafters

“It is our goal to grow as a leading company in the digital asset industry. We aim to provide superb services in the finance and investment sector.” — Hoon Song, Co-Founder of Block Crafters[49]

Block Crafters is a group of experts with individual successful track records in venture capital, serial entrepreneurship, gaming and consulting. It has started as a blockchain start-up accelerator in 2018[31], when Park Suyong, Hong Soon, Jangwon Lee and Chung Byung Hoon register Block Crafters and Block Crafters Capital in Singapore in 2018[2]. Since its inception, the company has reviewed over 500 blockchain projects from 20 different countries and has invested in several projects related to the protocol development, finance, gaming, mobility and SNS (Editor’s note: social networking services) sectors[49].

As a part of the change in the Korean business unit, Block Crafters was recently registered around 2020(Editor’s note: See Block Crafters Co. Ltd. in next section)[2] an accelerator at the South Korea’s Ministry of SMEs (Editor’s note: Small and medium-sized enterprises) and Startups. Additionally, alongside Block Crafters Capital and Haru Invest, Block Crafters also owns D.Street (which is a blockchain media platform in South Korea[31]), while also providing consulting and acceleration services via its other business units.

Its role as an accelerator includes finding prospective teams in the digital asset service industry (Editor’s note: particularly blockchain[31]) and supporting them with investment and incubation/acceleration programs[49].

Block Crafters Capital

Block Crafters Capital (Editor’s note: Established in March 2018, formally incorporated in January 2020 in 🇸🇬Singapore[42] and since May 2020 entirely owned by its parent entity Block Crafters[49]) is a subsidiary of Block Crafters, precisely a crypto hedge fund (later transformed into an accelerator[2]), with its first fund initiated in April 2018. Block Crafters Capital has built its reputation through its high-performing crypto fund over the last two years and has invested in more than 30 blockchain projects with a portfolio size of ~$70 million and a return of 270% as of December 2019[37].

HaruBank: Exotic origins from Vietnam, to San Francisco, to Seoul

HaruBank initially was a startup which kicked off in Vietnam[36] on 6th of August 2019 and garnered global attention from the beginning of the service. Led by the CEO, Hugo Lee, it embarked on a proper promotion from San Francisco within 3 months only to reach 100+ countries around the world[31]. Initially in 2019, the firm aimed at providing a “banking services for the digital assets”, particularly Deposits (but not Loans or Credits), while offering subscribers a competitive APR of ~10% without a lock-up and 12% of the assets are locked for 1 month[35].

During its early days, HaruBank was operated by crypto professionals from Block Crafters which managed the overall deposits flow — starting from the user’s account, to institutional loans* (Editor’s note: only during the early months of its development, as the company strictly moved away from loan operation later) and institutional asset management pools[37]. In December 2019[37] Block Crafter Capital has joined the asset management partner network of Haru Bank as its primary partner[37], while it also had six other partners around the world[80] (from 🇺🇸United States, 🇸🇬Singapore, and 🇯🇵Japan[37]) as of December 2019[73]. During this time the company also had a small crypto scene blog named Cryptalk[2].

Haru Invest: Capital attraction and Corporate restructuring

In August 2020, Haru Bank has changed its brand to Haru Invest, but more importantly in the following month has announced its strategic transition from mere cryptocurrency deposit yields company to an cryptocurrency asset management platform[63](Editor’s note: Meaning they would start providing advanced hedge fund style strategies to retail users). This is the definitive moment when Haru Invest abandoned its risky loan-deposit margin model[63], leading to an explosive growth for the company (Editor’s note: In loan-deposit margin model income is gained by lending the platform’s assets to borrowers who pay interest in return. Crypto holders generally have a higher desire to lend their BTC and ETH in exchange for an interest (but relatively few people want to borrow Bitcoin) while with stablecoins, there is a higher demand for borrowing[7]. This is why BTC and ETH earn rates in most yield platforms are lower compared to stablecoins and issues with bad loans troubles the model further, as seen later in the cases of companies utilizing it like Celsius or BlockFi. With algorithmic trading however, high earn rates for BTC and ETH are entirely possible[7]).

Following the rebranding and additional guidance from its parent Block Crafters, the company became independent, attracting vital seed capital and launching its flagship products Haru Earn Plus and Haru Earn Explore, which proved to be investor favorites[2].

Offices: 🇰🇷South Korea and 🇸🇬Singapore

Haru Invest’s South Korea office is currently located in Gangnam Seoul, and the parent company, Block Crafters Korea office is also located on the same floor (Editor’s note: A virtual tour of the office is available on YouTube too[2]). The address is:📍🇰🇷 Floor 17~18th, Gangnam-daero 327, Seocho-gu, Zipcode: 06627, Seoul, Republic of Korea[14][46].

The corporate headquarters of Haru Invest are actually located in Singapore, and the address is as follows: 📍🇸🇬 20 Collyer Quay #17–02, Singapore city, Zipcode: 049319, Singapore[14][46].

5. Corporate structure and residence

🇰🇷 Haru Invest Korea Co., Ltd.

Haru Invest main office, where the majority of the employees work, is located in the Gagnam district of Seoul in South Korea and is registered as Haru Invest Korea Co., Ltd. with address: 📍🇰🇷17/F 327 Gangnam-daero, Seocho-gu, 06627, Seoul[118].

🇻🇬 Haru Management Limited

Haru Management Limited is an “Approved fund” formation in 🇻🇬British Virgin Islands[19][38] (under the Securities and Investment Business (Incubator and Approved Funds) Regulations from 2015 of BVI[19]) as of February 2021[51], allowing it to take crypto assets as deposits from clients (not by the way of lending). Haru Management Limited is a subsidiary company of (Editor’s note: owned by) the Singapore holding corporation BCHaru Pte. Ltd., which conducts cryptocurrency based investments[62]. Since all company inquiries to the BVI Commercial Registry are carried out via phone, providing a direct link to the company was not possible[2]. The official regulations for registering an “Approved Fund” formation in the 🇻🇬British Virgin Islands are listed here[39], together with the updated requirements for 2020[40]. Approved funds can take various forms, such as mutual funds, hedge funds, and private equity funds in the British Virgin Islands[2]. The registration address of Haru Management Limited is: 📍🇻🇬 Unit 8, 3/F., Qwomar Trading Complex, Blackburne Road, Port Purcell, Tortola, British Virgin Islands[1][46].

🇸🇬 Block Crafters Co. Ltd.

Block Crafters Co. Ltd. is a corporate entity registered in 🇸🇬Singapore with Unique Entity Number (UEN) T20UF0290C via the Accounting and Corporate Regulatory Authority of Singapore on 10 January 2020 as an “Unregistered Foreign Entity”[42]. No specific address is provided for it in Singapore[2].

🇸🇬 Block Crafters Capital Pte. Ltd.

Block Crafters Capital Pte. Ltd. is a corporate entity registered in 🇸🇬Singapore with Unique Entity Number (UEN) 201807304N in the Accounting and Corporate Regulatory Authority of Singapore on 01 March 2018 as a “Private company limited by shares”. The company registration address is: 📍 🇸🇬 111 Somerset Road, #06–07B, 111 Somerset, Singapore 238164, Singapore[43].

As of May 2020, Block Crafters Capital Pte. Ltd. is no longer an “affiliate” (Editor’s note: or also referred to as a “special purpose entity”[67]), but a 100% subsidiary of Block Crafters. By holding an expertise in algorithmic / quantitative / active trading and arbitrage, Block Crafters Capital Pte. Ltd. was expected to operate as a “specialized blockchain investment firm”[67], supporting Block Crafters’ professional digital asset management and crypto fund services[49].

🇸🇬 BCHaru Pte. Ltd.

BCHaru Pte. Ltd. is the actual company which controls and owns the 🇻🇬British Virgin Islands based Haru Management Limited. It is a corporate entity registered in 🇸🇬Singapore with Unique Entity Number (UEN ID 202031889R) via the Accounting and Corporate Regulatory Authority of Singapore on 9 October 2020. The entity status is “Live Company”[44] and the type is “EXEMPT PRIVATE COMPANY LIMITED BY SHARES”. The principal activity is OTHER HOLDING COMPANIES, with a paid-up capital of 0 SGD as of present. The address of the business’s registered office is: 📍🇸🇬 38 NORTH CANAL ROAD, Postal 059294, with 5 registered officers[45]. The CEO of the company appears to be Suyong Park, who is also listed as a CEO of 🇸🇬Block Crafters Co. Ltd. and a managing partner in 🇸🇬 Block Crafters Co. Ltd.[86].

Chun Yang Hyun holds 50% Preference Share stake in BCHaru Pte. Ltd., while Oscar Consulting and Solaire Culture Plus Fund of Korea hold the other 50% Preference Shares. The largest ordinary shareholders are Park Suyong (39%), Song Hoon (34%), Joo Eunkwang (4%), the ex-CTO of Haru Invest and Chung Byung Hoon (4%), who is the co-founder of Block Crafters[2].

BCHaru Pte. Ltd. is the holding which currently operates the entire group under common control, since Block Crafters Co. Ltd. has transferred all its shareholdings to BCHaru Pte. Ltd., in a process known as a “corporate flip” (Editor’s note: A corporate flip, also known as a reverse merger, is a type of transaction in which a private company merges with a publicly traded shell company). Prior “the flip” (Editor’s note: which is reported to happen in early 2022[62]) Block Crafters Co. Ltd. used to function as the headquarters and the holding entity[62] (Editor’s note: of Haru Management Limited[2]). The team of Haru Invest believes this flip may provide a promising route to new financing and increased shareholder value over the long term. BCHaru Pte. Ltd. is controlled by the founding members while it also has about 15 registered shareholders (including Hugo Lee) who had their shares vested in Block Crafters prior to the corporate flip, as well as separate new equity investors, as seen in the recent media releases of Haru Invest[62]. Operating expenses are paid by way of transfer of pricing within the group entities and separately managed, with a focus not to exceed any client-owned deposits[62].

Block Crafters Co. Ltd. currently remains as an affiliate under the common control (Editor’s note: of BCHaru Pte. Ltd.), while providing group-wide operational and managerial support. The CEO of Haru Invest confirmed during a recent AMA that there are strict group wide internal protocols, risk control and compliance procedures to safeguard the clients’ assets and Block Crafters will not be able to access any of clients’ assets in case of a theoretical insolvency of Haru Invest. Additionally, it has been also explicitly confirmed that the assets of the British Virgin Islands entity Haru Management Limited does not exceed any liabilities which Haru Invest might have (as of 05 September 2022)[62]. This is a very important verification to be made by the CEO, as one of the director competitors of Haru Invest during 2022, Midas.Investments, has assured numerous times investors with the release of bogus “whitepapers” that it does not have any liabilities only to admit after Christmas 2022 to have a $60M assets hole in its finance books[2]. Additionally, Haru Invest is currently preparing for a financial audit, by consulting with external top-tier accounting firms[15].

Haru Invest was valued at $284 million in September 2022 and has attracted a $4 million (or about 1.5% of their total valuation[2]) as a strategic investment in BCHaru Pte. Ltd. from Cocone Corporation[47] (Editor’s note: Founded in 2008 in 🇯🇵Japan[48] and Japan’s leading Character Coordinating Play (CCP) service[67]), led by its founder and Executive chairman, Chun Yang-Hyun, who is also a Korean native[48] and former President of NHN Japan[17] and LINE Japan[49] (Editor’s note: No.1 messenger app in Japan with over 90 million Japanese users[50]). Mr. Yang-Hyun is one of Block Crafter’s initial angel investors and an advisor to the company, having also participated in Haru Invest’s previous investment round in summer 2020[67], during which he was joined by DT & Investment and T Investment (both venture capital firms based in South Korea[2]) in making a strategic investment in Block Crafters, with the details of the deal being confidential[49][17]. These funds are used for talent recruitment, global expansion and licensing fees[47].

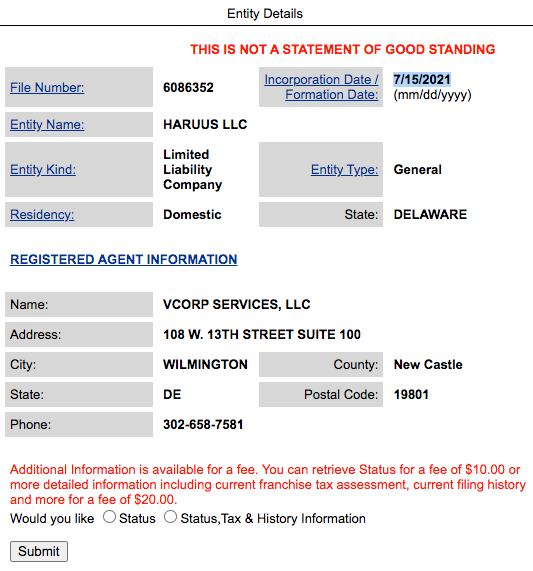

🇺🇸 HaruUS LLC

Haru Invest has also established legal presence in the United States via the entity HARUUS LLC which is a Limited Liability Company registered in the state of Delaware (Editor’s note: Delaware is widely recognized as being business-friendly state which does not have corporate income tax on companies that do not conduct business within the state[2]). The company is registered on 15 July 2021 with File Number 6086352108. The registered agent for the entity is listed as VCORP SERVICES, LLC with telephone: 302–658–758 and address: 📍🇺🇸 108 W. 13TH STREET SUITE 100, Wilmington, Postcode: 19801, New Castle, Delaware, United States of America[53]. Additionally for a $20 fee additional details on corporate status, tax and history information are provided by the Division of Corporations of Delaware[2].

🇪🇺🇱🇹 Haru EU Limited, UAB

Haru Invest has registered its European Union subsidiary Haru EU Limited, UAB in Lithuania on 30.09.2022. In March 2023, it has officially started a procedure for becoming Virtual Currency Exchange Operator or Deposit Virtual Currency Cash Operator[125]. The registration code of the company is 306246015, with manager Hyungsoo Lee, a capital of 125 000 EUR (with no debts), 2 employees and address: 📍🇱🇹 Mėsinių g. 5, LT-01133 Vilnius[123].

Investments in other companies

In February 2023, Haru Invest has taken part in a $9.2 million investment (Editor’s note: together with the two other companies participating in the round: digital assets trading firm Trinito and RFD Capital[111]) in Canadian-based crypto mining firm Pow.re, which utilizes stranded energy for crypto mining[2], during its Series A financing round[110]. As the company was valued at $150 million during, it could be theorized that the combined investment might be an equal of 6% in received shares or equity in the startup[2]. Haru Invest has separately invested an additional $18 million to facilitate Pow.re’s expansion in Paraguay[110](Editor’s note: Potentially meaning that Pow.re received an overall estimate of $27 million from all investors[2]).

Other registrations

In addition to the “Approved fund” formation in the British Virgin Islands, during the recent Haru Invest Meetup at The Hive Carpenter in Singapore on 26.09.2022, the CEO Hugo Hyungsoo Lee revealed to the attendees that Haru Invest is in the process of registering other companies the United States and South Korea too[2][52]. Allegedly, Haru Invest has been been trying to be legally present also in the EU, but no further details were provided about how and where[2][112].

NOTE: Haru Invest has stated it is not able or under any obligation to disclose its entire corporate structure[62].

6. Regulatory compliance

British Virgin Islands: New VASP scheme

James from the legal team of Haru Invest has shared that the British Virgin Islands Approved Fund formation of the company is also subject to the new VASP regulation scheme which has been announced in February 2023[2] and has 6 months of grace period for implementation[112] (Editor’s note: The Virtual Assets Service Providers Act, 2022 (the “VASP Act”) came into force on 1 February 2023 for companies in British Virgin Islands. The VASP Act regulates virtual asset service providers (“VASPs”) and requires that VASPs be registered with the BVI Financial Services Commission[2]). It’s currently not clear how the company is preparing for this regulation[2][112].

United States: Money Services Business license acquired

HARUUS LLC. has acquired a MSB license(Editor’s note: Money Services Business license)[55] on 29 June 2022 in the United States[19][56]. The address listed in the MSB for HARUUS LLC. is different than the one in Delaware and is: 📍🇺🇸 410 Sheridan Avenue, #337, Palo Alto, California, Zipcode: 94306, United States

The MSB license is granted by the Financial Crimes Enforcement Network (or shortly FinCEN, part of the U.S. Department of the Treasury) and is required for businesses that provide financial services (such as currency exchange, money transfers, and check cashing), ensuring that they comply with federal laws and regulations related to money laundering and other financial crimes[2].

ℹ️ Haru Invest might become unavailable to U.S. persons if SEC interprets its services as an “investment product”

U.S. Securities and Exchange Commission has announced on 9 February 2023 that it considers staking “an investment product”[2], therefore accusing the cryptocurrency exchange Kraken for failing to register it as such with the commission[2], eventually forcing the company to pay $30 million in disgorgement.

If we have to consider the technical term of what staking is (Editor’s note: Staking it the act of a group of coin holders merging their digital resources to increase their chances of blockchain validating blocks and receiving rewards for their participation[2]), Haru Invest does not participate in staking (Editor’s note: or at least we have no information about it[2]), rather being involved in active trading[2].

However, SEC has a complex history on defining what is considered a security and what is not when it comes to cryptocurrencies and companies and services related to it[2]. An article published in December 2022 in Harvard Law School on Corporate Governance suggests that a primary driver in SEC’s decision logic is “whether the blockchain project associated with a cryptoasset is, at any point in time, `sufficiently decentralized`”[2].

Additionally, James from the legal department of Haru Invest has actually admitted that the US regulatory crackdown on staking services (which started with Kraken) might also impact Haru Invest users in United States[112]). Ultimately, it is confirmed that Haru Invest might cease to offer services to U.S. persons, if needed[112].

UPDATE: As of 17 March 2023, Haru Invest will temporarily suspend new KYC registrations for citizens of USA, but those who have already registered as U.S. persons will continue to be serviced as usual[2].

South Korea: Working on the Special Financial Transaction Act

Korea Internet & Security Agency (KISA) has added a special amendment to their existing Special Financial Transaction Act (SFTA) which as of 05 March 2020 applies “not only to cryptocurrency exchanges but also to transactions relating to virtual assets in general”[57]. The government has announced that after a revision the assessment on the companies which fall within the scope of the legislation will consist of two phases. Haru Invest completed the preliminary assessment request on 05 September 2022 and is currently working on the preliminary assessment agenda. When this is done, it hopes to complete its additional approval as an SFTA company through FIU (Financial Intelligence Unit)[20].

On 09.05.2023 Haru Invest Korea has received Information Security Management System (ISMS) Preliminary Certification[116]. Introduced in 2022 by Korea Internet and Security Agency (KISA), this certification K-ISMS serves as a standard for evaluating whether enterprises and organizations operate and manage their information security management systems consistently and securely such that they thoroughly protect their information assets[117].

Singapore: Regulations need to be addressed

As of currently, Haru Invest has not shared any information about how they will address regulations imposed by the Monetary Authority of Singapore (MAS), especially the ones after the FTX’s collapse[2].

European Union: VASP authorization obtained

On 27.03.2023 Haru Invest subsidiary Haru EU Limited UAB[123], has received a VASP license from Lithuania, giving it righ to operate within the European Union. (Editor’s note: Virtual Asset Service Provider is defined by Financial Action Task Force as any business which transfers or exchanges between virtual assets, exchanges between virtual and fiat assets, or is involved in administration of virtual assets or any financial services related to them[124].)[122].

With the VASP authorization, Haru Invest can now provide crypto exchange and wallet services, and is on track to become a full-scale crypto exchange with a fiat gateway. This enables individuals in EU countries to easily buy and trade crypto with Euros directly on our platform. Additionally, reportedly “as a part of the VASP registration process, Haru Invest underwent a thorough evaluation of its compliance and risk management procedures, as well as due diligence on its corporate governance and business operations.”[122].

Auditing

The assets invested by the customers in Haru Invest are managed by the internal management team within Haru Invest, and some of them are managed by more than 10 distinguished partners[18][12]. The customer’s cryptocurrencies invested in Haru Invest are solely used for the investment strategy and are not used for any other purposes[18]. Asset management partners around the world — based in the United States, Singapore, and JapanUnited States, Singapore, and Japan[37].

Haru Invest has not been independently audited yet, however, it was confirmed that public audits have been done for “equity partners” (Editor’s note: Most likely investors in 🇸🇬BCHaru Pte. Ltd.), but those were based on based on fiat currency[12]. Hugo Lee indicated the company is actively seeking auditors, but finding the proper type of audit for the business model of Haru Invest was “extremely difficult”[27]. Reportedly, other similar platforms do not have this problem (Editor’s note: Since they are using deposit-loan lending models, which tend to hold the assets in a more centralized manner[2]), but since Haru Invest operates on the algorithmic trading model (and the crypto assets are allocated and traded in real time across multiple exchanges) the company has received comments from auditors saying that it is extremely difficult to carry out an audit using fiat standards[12]. He has also mentioned that these challenges have been one of the reasons why they have settled for an “approved fund” formation in the British Virgin Islands[12].

It seems there’s still no perfect match in terms of a license for the business model of Haru Invest and the team is still trying to explore other alternatives with its in-house lawyers and other law firms in order to ensure a stable service[41][12].

As of July 2022, it has been confirmed[12] (and reiterated in September 2022[62]) that Haru Invest has reengaged with a top-tier auditing firm to implement/create a crypto-asset audit system (Editor’s note: as it appears that globally such a system still does not even exist[2]) in order to provide more transparency in its asset management process[62]. Lastly, it has been suggested that the Terms of Service could also be updated in order to reflect a more transparent and reliable asset management platform[62].

During the February 2023 Reddit AMA a representative of the company, Christen, has stated Haru Invest is still in the “consultations phase”, precisely being stuck with defining “financial reporting standards”[112] with auditing companies[2].

7. People: The team of Haru Invest

“There are a total of 50 people working at Block Crafters and about half of them are working on the Haru platform.” — Hugo Hyungsoo Lee, CEO of Haru Invest[31]

The team of Haru Invest has mentioned multiple times that they try to establish a culture of open communication and innovation[31]. Yet, as the information about the team structure was scattered across the many interviews the company gave, we have tried to gather all of them together in one place[2].

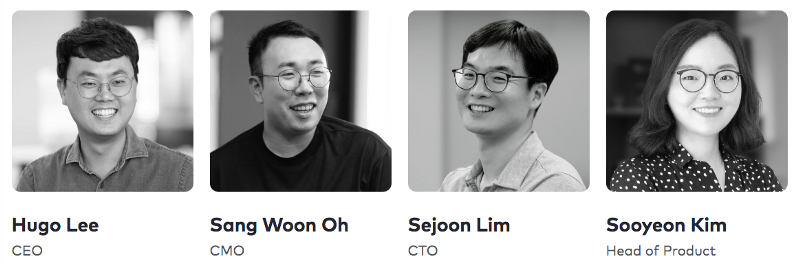

Managers

- CEO: Hugo Hyungsoo Lee (Linkedin, Interviews from 2021, 2022, 2023)

- CMO: Sang Woon Oh (Linkedin)

- CTO of Haru Invest: Sejoon Lim (Linkedin)

- CTO of BlockCrafters: Eunkwang Joo[77] (Linkedin, Interview with him from 2021)

- Head of Product: Sooyeon Kim (Linkedin)

- Head of Design: Elly (Interview with her from 2022).

- CRM Manager: Rachel (Interview with her from 2022)

- Social Media Manager: Cathy (Interview with her from 2022)There several core team values at Haru Invest, with the most important ones being “Everything starts with integrity”, “Always try to explore a better way”, and “Empower everyone”[41].

The office atmosphere of Haru Invest (and some of its employees) can be seen in a video in their website, as well as in their recent presentation in Asia Crypto Week in Singapore. What’s more, one third of the team are graduates of the prestigious Korea Advanced Institute of Science and Technology (KAIST)[77].

When it comes to engineering, Haru Invest has two team: one developing the investment algorithms (system trading, quant engineering, and modeling) and another which is in charge of developing the investment platform of Haru Invest. Both teams attend two meeting per month where they measure the overall progress and realign with each other. The groups have common study sessions which are voluntary to attend. Moreover, there are quarterly session meetings where everybody shares what they have done and learned with the rest of the members[77].

Finally, current open positions and more company employees can be seen on the official recruitment page of Haru Invest on Notion[3].

The CEO of Haru Invest: Hugo Hyungsoo Lee

Naturally, the person who brings and holds the core ideals is always the CEO (Chief Executive Officer). Below is a portrait of Hugo Hyungsoo Lee (who has joined initially Block Crafters in 2018[31]) in his own words:

“When I joined the company in 2018, I was concentrating on accelerating programs. (…) I majored in electrical and electronics Engineering at Korea Advanced Institute of Since and Technology (KAIST) and joined Doosan Heavy Industries and Construction. Back then, Doosan was more than just baseball; Doosan was doing pretty well in the generation sector. Anyway, I realized my skills with engineering major was not good enough for the large scale plant industry, so I went to the Graduate School of Business at Sungkuynkwan University for MBA where I studied financial accounting and afterward worked in investment management firms, mostly responsible for financing projects at home and abroad.”[31]

According to Hugo, one of the reasons why CeFi platforms like Haru are in demand is because in the crypto realm, no one wants to borrow coins, but rather providing their crypto assets as collateral for a loan, since everybody have bought them with expectations for the price to go up[31].

Additionally, Hugo Lee sees Haru Invest rather as an “Asset management factory or asset management corporation”, adding that “cryptocurrency will become a core asset in the finance industry”. Moreover, he believes that traditional assets in finance markets (“securities, savings, custodies, insurance”) will be duplicated in the cryptocurrency space and Haru Invest hopes to be a pioneer in this emerging financial field. Finally, he confirms Haru Invest is actively preparing for these events[2].

8. Platforms: Web, iOS and Android

Haru Invest is accessible on all popular platforms:

Technological infrastructure

The mobile applications of Haru Invest were released in August 2021 and are developed using the hybrid framework React Native (Editor’s note: Which allows to support both platforms by writing almost the same code)[77].

The back-end (Editor’s note: Meaning business logic and server operations) are written in the Python programming language, using the famous Django web framework[77]. Some of the modules are also written in Go (Editor’s note: Golang, programming language developed by Google which is popular in blockchain projects[2][77]), which is used for building microservice architecture for Haru Invest, but it is not the main language. Part of the reasons why GO is also used is because it allows splitting things into individual microservices, while Python (and Django) support mainly monolithic architectures[77].

9. Assets supported

Haru Invest keeps it simple and focused when it comes to supported cryptocurrencies. Investors can deposit and earn with the following assets:

- Bitcoin ($BTC)

- Ethereum ($ETH)

- Tether USD ($USDT)

- Ripple ($XRP) — Added in August 2022[1]

- USD Coin ($XRP) — Added in November 2022[1]

Low fees with XRP

The main reason why XRP was added to the platform is to allow users to add crypto to Haru Invest with low fees[62].

USDC as a shield during tough times

It’s important to note that the addition of USDC in November 2022[2] provides an additional way to “hedge” your investments in Haru Invest (or simply protect yourself against incoming market downturns). A fully reserved stablecoin, each digital dollar of USDC is backed by real cash and short-term U.S. government bonds, ensuring that it can always be exchanged for a physical dollar. The reserves are held by reputable U.S. financial institutions and are independently audited by a major accounting firm on a monthly basis to confirm the size of the reserve[6].

A little known fact is at some point Haru Invest also supported Terra KRT[2][34](up until January 2021[67][78][81]), but it was delisted around 2021[12] — long before the infamous meltdown of Terra LUNA in 2020 — as the management already saw serious risks in the reliability of UST, and decided to focus on USDT instead[12].

New possible additions

Haru Invest does not exclude the possibility of adding new cryptocurrencies to its platform. It is revealed that a crucial criterion for consideration is for a coin to have a “certain number of trade volume across multiple exchanges”[12] (Editor’s note: Which logically corresponds to the notion that since Haru relies mostly on small inefficiencies, and therefore increased volume and volatility, that statement is perfectly in line with their supposed business model[2]). The team has confirmed that Bitcoin Lightning Network is on their roadmap[12], while being also very positive about adding support for additional blockchain networks (with Polygon network revealed to be considered due to its lower fees[12], together with BSC too[62]).

Additionally, there are indications about possible direct fiat deposits being considered as well[2][10](Editor’s note: See ‘Next steps’ section).

10. Products

Haru Invest offers different earning rates, with different withdraw availability and principal guarantees in order to accommodate both conservative and aggressive investors, together with providing non-standard liquidation and trading options too (should you need them).

Haru Invest’s main products are Haru Wallet (which pays out daily interest, allowing withdrawals at any time), as well as Haru Earn Plus (14–365 day lock-up with principal guaranteed[62]) and Haru Earn Explore (providing access to the highest earning strategies with a 3 months lock-up, but no principal warranty). Additionally Haru Switch allows users to trade their assets via custom buy/sell orders, while Haru Freeze & Marketplace offers unique artifacts and premature liquidation options for Haru Earn Plus deposits[1][2].

Haru Wallet: Earn daily, withdraw any time

Haru Wallet (Editor’s note: Initially called “Haru Earn”, but renamed in 2021 to avoid confusions[2][68]) is the default product, which you receive as soon as you deposit your crypto to the platform. It is a secure custodial wallet that supports deposits of BTC, ETH, USDT, USDC, and XRP with no lock-ups (your assets are always available for trading/withdrawal) and investors can 24/7 request withdrawals to external wallets at any time with no daily limits[13][61]. Haru Wallet is mainly designed for transaction activity[61] (especially if you want to keep some of your assets liquid or speculate on price changes).

You can indeed hold your holdings on your Ledger, but why not also earn daily compound interest on your dormant assets, while Haru does all the hard work for you? Also, did we mention that all assets in Haru Invest are protected by BitGo[83] (which is recognized as the industry standard when it comes to securing crypto assets)?

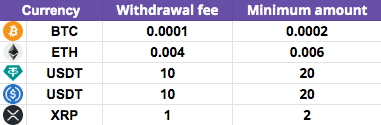

ℹ️ Haru Invest withdrawal fees

The withdrawal fees of Haru Invest are also among the lowest in the industry[2][61].

ℹ️ Withdrawals processing

Unlike many of its competitors (and even exchanges), Haru Invest does not maintain a “active balance wallet”, which can be drained instantaneously, while waiting later to be refilled (from the actual profits), which provides swifter customer experience, but obvious liquidity risks.

No, nothing like that. Rather, Haru Invest embraces a true “organic liquidity” approach.

When a withdrawal is requested in Haru Invest, the customer is required to wait for the asset to be actually withdrawn from the exchange (Editor’s note: Almost all algorithmic trading of Haru Invest is carried out on major exchanges[2], details described at next section), go through several security protocols to the BitGo cold wallet, before being approved by the team to finally go to the user’s wallet[13][12]. All withdrawal requests are processed apparently on batches[2] and the whole process might take up to 24 hours. On average it takes about 8-10 hours[13](Editor’s note: Since the funding fee rewards are delivered every 8 hours on major exchanges) and a maximum recorded wait time of 22 hours[2](Editor’s note: Personal subjective record of the author). If you happen to place your request right prior a transaction batch, you might get your transaction processed in less than 2 hours too[2].

Hugo Lee has asserted that “hot wallets can easily be exposed to hacks” and that it is not safe “to support instant withdrawals via hot wallets”[62].

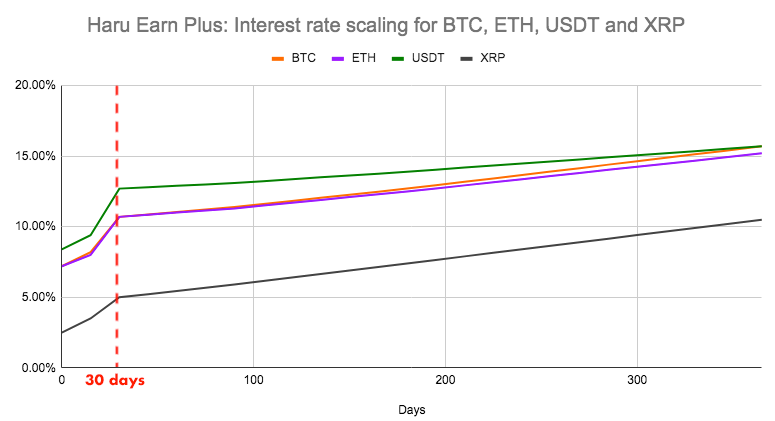

Haru Earn Plus: 14–365 day lockups with fixed interest

Haru Earn Plus appears to be the most used and loved product of the company (Editor’s note: Based on unofficial research and some secondary-level derived usage data[2]). That’s easy to understand, as it provides a fixed interest rate for your lock-up, with the earnings being delivered daily, and the principal being absolutely guaranteed[62] (Editor’s note: In the own words of the CEO: “Our principal guaranteed policy applicable to Earn Plus is a bilateral contractual obligation between Haru and the user holding assets under this product. (…) our asset management model is designed in a way that at least the pay out of Earn Plus principals is guaranteed in usual situations and we will also make best efforts to guarantee the pay out of principals with our own assets in case of insolvency.”[62]). The duration of the lock-up can be anywhere between 14–365 days, with a historical maximum of up to 13% APR. For the convenience of long-term investors there’s an auto-renewal function too[2]. There have been requests for longer lock-up periods, but they have been deemed as being impractical both for users and the management[62].

ℹ️ Interest scaling

A past analysis on duration versus interest scaling (Editor’s note: For year 2022) has demonstrated that the duration-to-interest ratio scales exponentially up to 30 days, after which each additional day in lockup duration grants a linear increase in interest rate rewards[2].

ℹ️ Premature liquidation

Additionally, users can liquidate prematurely their Haru Earn Plus lockup, by using Haru Freeze and selling their “frozen” lockup to somebody else on the Freeze Marketplace (Editor’s note: Described later in Haru Freeze & Freeze Marketplace section)[2].

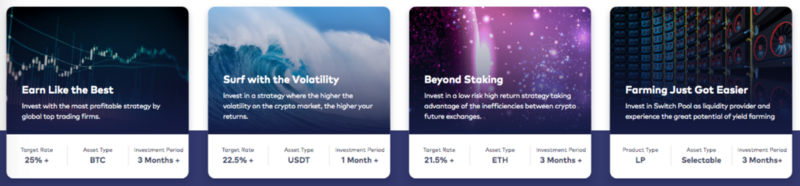

Haru Earn Explore: Premium yield strategies

Haru Earn Explore is the most advanced flagship product of the company (with an fixed lock-up period of ~1-3 months) and it provides performance-based high yields (up to 25%) via automated investment. It strives to deliver the same premium strategies and profits, which are used by boutique hedge funds and global trading firms, which serve only investors with large deposits in exchange for significant management fees[2]. The product utilizes automated algorithmic trading (hybrid HFT, market neutral strategies, fiat-future market trading, hedging[31] and others which are covered in-depth in the “How Haru Invest makes money” section)[2].

The Haru Explore performance rate is updated every two weeks and published on their official blog[28]. There are no fees unless performance exceed 15% APR, when a management fee of 15% is applied on the profits only[31][64](Editor’s note: Recently a Reddit has calculated, together with a graph, that it is practically more profitable for investors when the fund performs in the 13–14% range rather than in the 15–17% one, due to the fee structure. Precisely: “You would need to earn 17.60% to beat someone making 14.90%, because of the fees.”[71]).

Unlike Haru Earn, Haru Explore lock-ups cannot be traded via the Freeze Marketplace. It’s also worth mentioning that while $BTC and $ETH require 3 month lock-ups, the $USDT strategies can be utilized for 1 month only[31]. There is a handy auto-renew option for long-term investors too[2]. Members are in no case allowed to withdraw deposit assets during the pre-agreed subscription period. Principal or return on investment are not guaranteed[1].

After the investment period is concluded, within 3 business days investors receive the principal together with all profits or losses in their Haru Wallet[26](Editor’s note: During it’s 2.5 years history, Haru Explore has never registered a negative performance as of yet)[66][2]). You can see all past performances of Haru Earn Explore on their website[28] and their Medium blog (where they post it regularly).

Strategies:

- Earn Like the Best Currency: BTC, Lock-up: 3 months, Target APR: 25%, Launch: September 2020)

- Beyond Staking (Currency: ETH, Lock-up: 3 months, Target APR: 21.50%, Launch: April 2021[89])

- Surf with the Volatility (Currency: USDT, Lock-up: 1 month, Target APR: 22.50%, Launch: October 2020[65])

- Farming Just Got Easier (Currency: BTC, ETH or USDT, Lock-up: 3 months, Type: Liquidity pool, Launch: December 2021[88])

The first three strategies, which utilize only a single asset, have never registered a negative biweekly performance since the fund’s launch in September 2020 and have practically demonstrated an average performance of 15–19%[2] during most of the time (depending on market conditions).

“Farming Just Got Easier” is essentially a form of liquidity farming (Editor’s note: The act of lending/staking your cryptocurrency into a liquidity pool, to receive rewards such as more of the staked cryptocurrency[87]). The performance is based on how many of trades carried out via (Editor’s note: the trading pools of) Haru Switch. This means the three main factors that decide the returns are market’s condition, Switch trades volume[62], and the relative size of user’s assets in the pool. You also have to be warned, that often the yields of stablecoins (USDT) are inversely related to those of cryptocurrencies (Editor’s note: e.g., if you see positive USDT yields, you can expect negative ones with BTC/ETH[1][2]). Additionally, it is often the case that prices fluctuate resulting in big positive and negative gains with Farming Just Got Easier. The fundamental strategy of liquidity farming is to deploy a stable coin and cryptocurrency pair, with which even if one of the items goes down (due to liquidity demand), you would — theoretically — still profit from collecting trading fees (but please consider the effect of Impermanent loss). In general, “Farming Just Got Easier” remains quite unpopular among the veteran investors of the platform[2].

Some remarks on Haru Explore

Initially launched as Haru X on 4 September 2020[33][63][65], it was renamed to Haru Invest in October 2020[64] and finally to Haru Earn Explore in August 2021[32]. During its first two weeks after launch Haru Explore (particularly “Earn Like the Best”) has wowed investors with APRs of 24.85% and 30.99%, but the performance rate has been realistically under the 20% mark since then[2]. However, even as admitted by the CEO, actual performance has been ranging between 15–20% for most of the time[62] (excluding 2020, when Haru X performed at ~20–21% for BTC and ~22–25% for USDT[78][82]), with a rough average of ~17% during the period of 2021–2022[2].

Additionally, it used to be case that the payouts were delivered only in the last day of each yearly quarter[65](unlike present when it’s the last day of the third month, following the starting month). Building on the current rules, investors have to be aware that if they make a deposit on 02 January 2023, their investment period will conclude on 01 May 2023[2].

Haru Explore depends significantly on trade volume and works best when there’s a lot of volatility in the market[2][67][12][80](Editor’s note: Meaning the prices often significantly fluctuating over short time intervals).

Haru Freeze & Freeze Marketplace

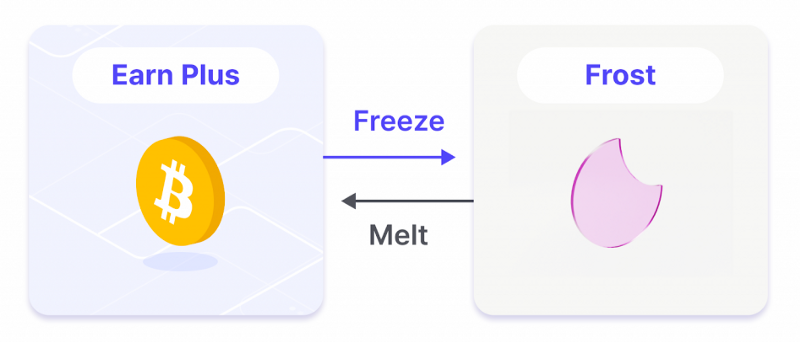

Haru Freeze is one the products which appears to be misunderstood and it seems like still many users don’t realize[62] they can actually “cancel” their active Haru Earn Plus lock-ups, using Haru Freeze to create a Frost, and sell it (with some discount) in the Freeze Marketplace.

Haru Freeze essentially it allows you to sell prematurely your Haru Earn lock-up (by “freezing” it into a Frost) on the Freeze Marketplace with some discount to somebody else (and get some of your lock-up value instantly), while the buyer would enjoys some profit. Additionally there are limited unique artifacts named Crystals, providing unique benefits, that can be gained once you collect specific Frosts. Frosts and Crystals are treated somewhat as NFT (Editor’s note: Non-Fungible Token[91]) by Haru Invest and there are future plans for these artifacts to become tradable on other networks too[1].

Let’s try to clarify each of the components of Haru Freeze separately:

Frost: Any Haru Earn Plus lock-up can be converted into a tradable Frost via “freezing” with Haru Freeze[1][2], which causes the principal amount, leftover earnings, and the total lockup period be “frozen”[90]. The Frost can then be sold on Freeze Marketplace (Editor’s note: with a slight discount to a buyer who can “melt” it back to an Earn Plus lockup and get slightly higher earn rate at a discounted price[1]). Once melted, the earn rate of the Earn Plus lock-up will recover to the same rate before being “frozen”, and the remaining lock-up days count will recover too[1].

Alternatively, users can combine several different Frosts (which specific requirements) in order to create a unique Crystal (which provides unique benefits). A Frost contains the principal amount, lockup period, earnings payouts, and earn rates with a digital art NFT[90]. While a lock-up is in Frost form, its Haru Earn Plus revenue is halted, but daily earnings for the lockup amount are still provided[1] in accordance to Haru Wallet earn rates[90]. A detailed explanation on how to create and sell Frosts is available here[1].

Crystal: An unique item which can be created once several Frosts (which must fulfill certain requirements such as duration, currency and sum) are combined together. Each crystal provides an unique benefit to the owner (Example: -1% on Haru Explore management fees). Limited numbers of Crystal collections are available during “Collection seasons”[1] which are periodically announced by Haru Invest (Here are some past Crystal collections issued for BTC, ETH and USDT)[2].

Freeze Marketplace: The Freeze Marketplace is the venue where all published Frosts are freely listed selling to all investors, while My Freezer where users can view personal collections of Frosts owned or Crystals created[2]. It’s worth mentioning that Frosts can be purchased at huge profits or loss too[2]. There have been users who were trying to scam other by putting obviously misleading offers on the marketplace (Editor’s note: For example selling a 365 day lock-up of 0.01 BTC for 1.00 BTC), which were initially hard to distinguish, due to the visual styling of the interface. The approach of Haru Invest was rather to strive to improve the legibility of obviously misleading offers, rather than to directly intervene/limit the free market forces between the users, while also confirming that 95% of “frozen” lockups (Editor’s note: with a reasonable discount) getting sold within a day. The team also does not cater or guide “whales”[62].

Haru Switch: Trade your crypto instantly

Haru Switch provides the ability for users to swap their crypto into any other of the support ones for the platform. Users can place buy / sell orders either at the current market price, or at a specific expected price[93].

Essentially, Haru Switch is a peer-2-peer pool, which is driven entirely by investors who subscribed as liquidity providers with the “Farming Just Got Easier” strategy of Haru Earn Explore.

The swapping fees are minimal (0.20%[1][92]) and split between the liquidity providers (proportional to their deposited assets’ share in the pool) and Haru Invest (although their profit is marginal[2]).

It’s important to note that Haru Switch is available only for non-locked assets stored in Haru Wallet (e.g. you cannot trade part of your Bitcoin which is allocated inside a Haru Earn lock-up or a Haru Explore strategy[2]). From current information, Haru determines internally the switch prices[10].

11. Miscellaneous features

Some additional extra features which Haru Invest supports are:

- Transactions & tax reporting: Exporting of all transactions (for tax purposes). Haru Invest has recently also partnered with CoinTracking[126] to provide even smoother reporting experience for users (together with a -10% discount).

- Price notifications: In the mobile application, there is an a handy option in Haru Switch to set a price alarm notification, which will be delivered immediately when the selected cryptocurrency reaches that point.

- Haru Luminary Club: Released in October 2022, this feature provides VIP earning benefits (such as extra interest rates) for major investors who achieve earnings above a certain threshold. Application to the club is done manually via the website[92].

12. How Haru Invest works: Strategies, Risk, Traders

“Financial institutions and investors were making big gains using low-risk strategies like arbitrage and we wanted to find a way to help everyone experience the power of these digital assets.” — Hugo Lee, CEO of Haru Invest[31]

The most debated aspect about Haru Invest is of course their “secret sauce”:

How does Haru Invest make money even during the darkest periods of the world crypto market when even more sizable companies are simply failing and going out of business?

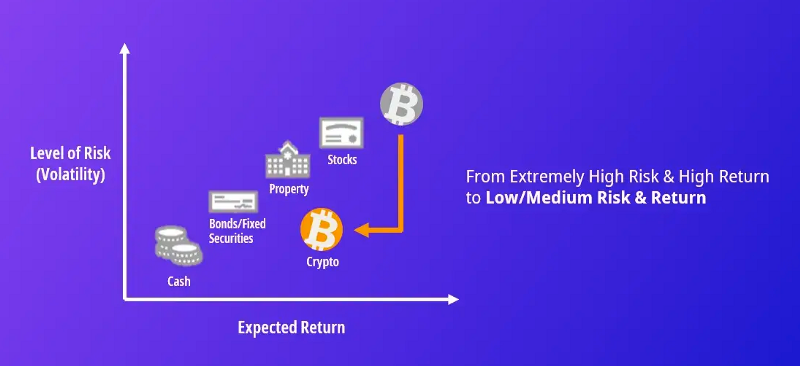

The main thing which Haru Invest strives to do is to maximize the safest possible yield strategies when it comes to crypto[2]. Particularly, Haru Invest focuses primarily on algorithmic arbitrage trading over multiple different derivatives exchanges, utilizing the inefficiency gap in these markets and taking little amount of the profit in a high or medium frequency basis, thus increasing the amount of the crypto assets’ size without being impacted by price fluctuations[10]. This is the fundamental reason why the company is able to consistently profit during both bull and bear markets (e.g. it makes no difference whether Bitcoin is priced $10,000 or $100,000).

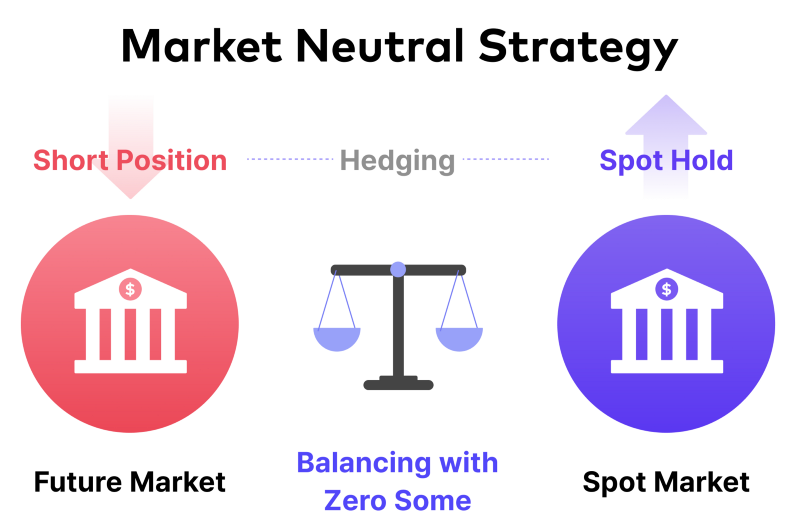

Ultimately, Haru Invest focuses on gaps and differences of perpetual futures[10](Editor’s note: An agreement to non-optionally buy or sell an asset at an unspecified point in the future[95][104]) and farming funding fees[10][2][67] (Editor’s note: An unique fee, which are a small percentage of your position’s value, which you must pay/receive at regular intervals to make the perpetual futures contract price is close to the index price[96]). These are unique mechanisms (Editor’s note: and artificial inefficiencies) found only in crypto markets, and particularly in major crypto exchanges[2], and their usage has been confirmed by the CEO during Reddit AMA[12], and later on YouTube[10]). At the third Reddit AMA it has been clarified the trading strategies used for Haru Earn Plus and Haru Earn Explore are fundamentally different (with the first group being significantly more conservative[112] (Editor’s note: secure)).

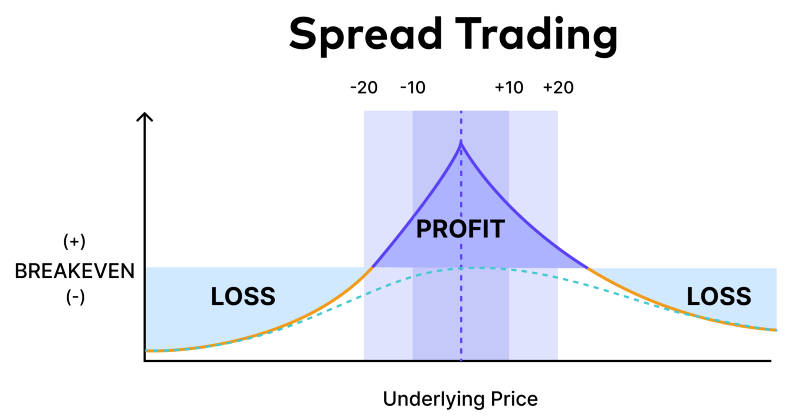

Alongside market neutral trading strategies and arbitrage the company also significantly relies on differences in basis of future market and funding fees[62] and spread treading, focusing on futures contract volatility[67]. New strategies are being developed in the options trading and stat arb (Editor’s note: Statistical arbitrage) fields[62]. Haru Invest has greatly utilized the Kimchi premium effect (Editor’s note: An unique paradox resulting in the price of Bitcoin being higher on South Korean exchanges due to legal restrictions imposed by the government[69]), but has slowly diversified away from it* (Editor’s note: Confirmed here¹ and here²) since 2019, as the management realized its profitability would eventually diminish over time[62]. Haru Invest also boasts with zero principal loss since its inception in 2022[1][2].

Strategies

Haru Invest utilizes an algorithmic mid-High Frequency Trading[1] model (Editor’s note: A method of trading that uses powerful computer programs to transact a large number of orders in fractions of a second[98]) to execute primarily 4 types of hedged risk-averse strategies[99]:

- Arbitrage trading strategy based on crypto derivate exchange

- Market neutral strategy based on crypto derivate exchange

- Calendar spread trading based on crypto derivate exchange

- Other evolving strategies: Other options trading, Stat arb, and others.

1️⃣ Arbitrage trading strategy

The definition of arbitrage is to buy an asset in one market and to sell it for a higher price in another one[2]. Since the price of Bitcoin is not the same across all exchanges (due to differences in volume and trades) there are always some arbitrage opportunities due to the price gap between crypto marketplaces. Unlike the traditional equities market where the stocks are listed on a single exchange, cryptocurrencies are tradable across hundreds of different exchanges, and since the order books are not shared across these exchanges, there are always price gaps between exchanges that can be continuously leveraged by Haru Invest via arbitraging[107] for stable marginal profits regardless of the prices[9]. Actually, the more volatile the price BTC is, the higher the price gap becomes between different marketplaces. When Haru Invest launched in 2019, Hugo Lee thought that relying on these arbitrage inefficiencies between spot exchanges only was going to become less profitable (as the free market has a tendency to balance itself).

However, inefficiencies doesn’t just exist between spot markets, as Haru Invest separately utilizes advanced arbitrage between derivative markets (which trade with futures contracts, options and etc.), where they focus on the differences in perpetual futures and funding fees[12], by using various indicators which reveal the gaps in the market (as we will next see).

2️⃣ Market neutral trading strategy

Market neutral trading is a strategy that aims to generate profits regardless of the direction of the overall market (Editor’s note: Bull or Bear). Executing such strategies is not easy in traditional finance markets have very conservative limitations.

However, things are different with crypto markets, which operate without interruptions and with unique mechanisms, which inevitably create some arbitrage opportunities. In the case of Haru Invest this is done via relying on the unique price stability mechanisms present only in the crypto futures markets[2][9]. But first, let’s clarify some concepts:

- Spot market: A financial market in which the trades are executed with assets being delivered immediately, right on the “spot”[2].

- Futures contract: A contract to non-optionally buy or sell an asset at an unspecified point in the future[104]. Futures contract expirations are grouped into 1 month, 3 months, 6 months, and 12 months, as futures are all about predicting the value of the asset in particular time in the future[22].

- Futures market: A market in which participants buy and sell futures contracts for delivery on a specified future date[101]. Futures trading typically requires a margin account (Editor’s note: A margin account allows a trader to borrow funds from a broker, while not needing to gather the entire value of a trade personally, using that account (or the purchased goods) as collateral. For example if you have 0.50 BTC in a margin account, you could borrow 0.50 BTC from the broker and buy futures or options worth 1.00 BTC[2][102]).

- Perpetual futures: Unlike regular futures contracts (which expire in 1–3–6–12 months[22]), perpetual futures don’t have an expiration date, and are consolidated into a single group, maximizing the number of possible contract and allowing traders to buy or sell an underlying asset without a pre-specified settlement date[2][22]. Traders can keep open positions in perpetual futures indefinitely and close them at any time. Perpetual futures use inverse price dynamics — if the price of the underlying asset rises, the price of the perpetual future may fall, and vice versa. Perpetual futures also have a unique mechanism for maintaining price stability known as a funding fee/rate[2][103].

- Funding fee: An unique price stability mechanism for perpetual futures, which is a small percentage of trader’s position value (buy or sell), which must be paid/received at regular intervals (thus encouraging others to buy or sell) to make the perpetual futures contract price is converge with the asset prices on the spot market[2][96]. In most exchanges, at least 0.01% of the long position (Editor’s note: sale) volume every 8 hours. Since most users in the crypto market are holding their assets with a long-term vision, there are far more cases in which the long position holders (Editor’s note: buy) pays the funding fee to the short position holders[22]. The funding fee mechanism allows traders with short position to earn returns as long as the price falls at the 8-hour mark when the funding fee is paid. And even if the price stays the same, they are still earning a profit from the funding fee[22].

These newly introduced unique mechanisms in crypto futures market created a new kind of inefficiency which does not exist in the traditional financial markets[9].

Basically, Haru Invest embraces the profitability of the price stability mechanisms by maintaining a zero-sum balance between the two position[9]. The firm is fairly transparent about their strategy and a full description of the entire market neutral strategy is published here[22]. It can be also speculated that the company only trades on exchanges which support derivative/perpetual futures trading too[2][195].

Exchanges (especially Binance) are quite open when it comes to the existence of those inefficiencies between the spot and futures markets, and they actually encourage users (or companies like Haru Invest) to capitalize on these opportunities, so the markets are balanced. Supposedly, the easier it is to carry out the “equalizing arbitrage” on an exchange, the lower the funding rates are in that exchange[23].

3️⃣ Calendar spread trading strategy

Calendar spread trading strategy involves buying and selling two options (Editor’s note: An option is a financial contract that gives the buyer the right — but not the obligation — to buy or sell an underlying asset at a predetermined “strike price” until a specified “expiration date”. Options are used to hedge against market risks or to speculate on price movements of the underlying asset[2]) with the same underlying asset but with different expiration dates. The value of an option is influenced by several factors, including the price of the underlying asset, the strike price, the expiration date, and the volatility of the underlying asset.

In calendar spread trading, the trader buys a longer-term option (the long option) and sells a shorter-term option (the short option) with the same underlying asset, hoping to profit from the time decay of the options. The idea behind this strategy is to take advantage of the time decay of options, which means the value of options decreases as their expiration date approaches. If the price of the underlying asset remains unchanged, the value of the long option is expected to increase, while the value of the short option is expected to decrease. This creates a profit for the trader, known as a “calendar spread”[2].

In the case of Haru Invest, the firm focuses on the volatility of BTC/ETH futures contracts (Editor’s note: There are gaps between options with different maturity in different exchanges, since order books are not shared[2][21]). It does that by buying and selling options with different strike prices at the same maturity or buying and selling options with different maturity at the same strike price[9][21].

This type of spread trading is considered a low-risk, low-reward strategy, as it profits from the time decay of options rather than large price movements of the underlying asset[2].

4️⃣ Evolving strategies: Options trading, Stat arb, and others.

The trading units of Haru Invest are constantly researching, developing and evolving new algorithmic strategies, which are managed by the in-house trading teams and the partners to generate additional earnings or respond to changes in the crypto market[12]. It appears the current focus is on strategies specializing in options exchange, together with specific tendencies of each cryptocurrency[100].

Traders: 2 in-house teams and 10+ global partners

ℹ️ In-house teams

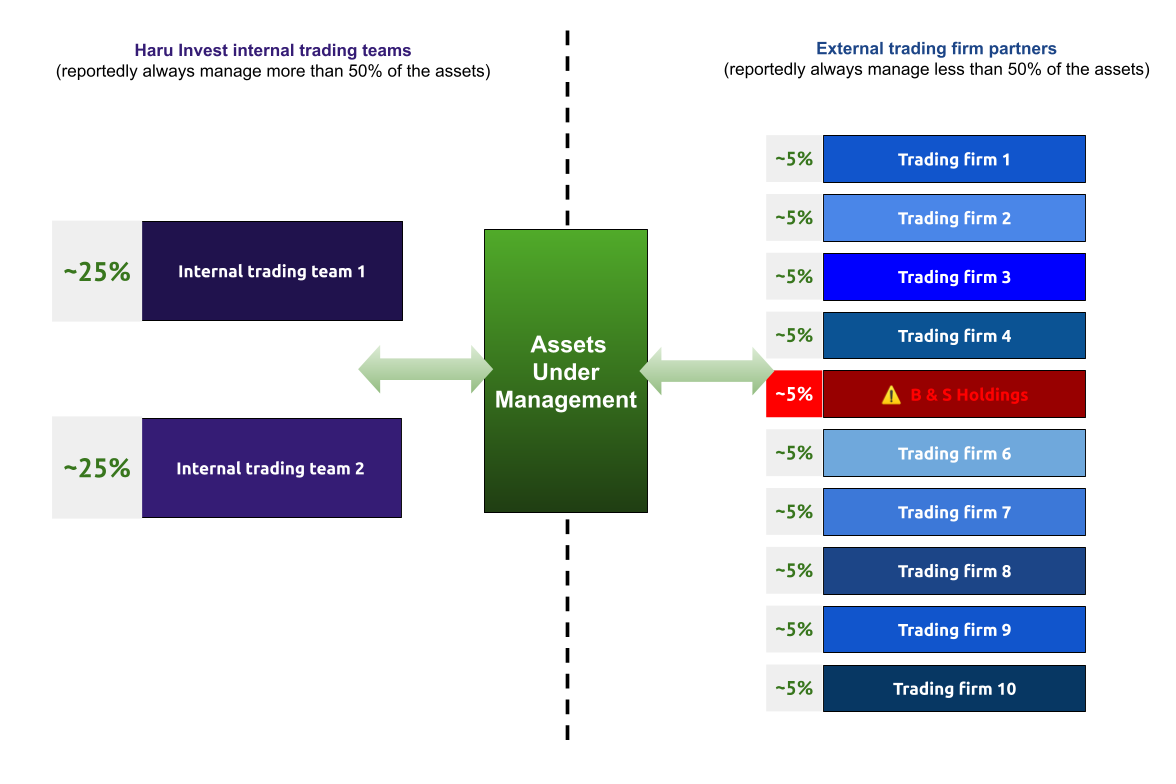

To execute its trading strategies Haru Invest relies on the expertise of two in-house trading teams[7][10], which are independent of each other[9](Editor’s note: Reportedly some of the traders are ex-employees of big trading firms such as Millenium, Jump Trading, World Country and others[2][10]), together with more than 10 global partners[12].

It is claimed that the first team utilizes the “market-neutral strategy”, while information about the second team has not been published[2](Editor’s note: We could deduce perhaps the “market neutral strategy” has the largest volume of utilization, while the second team could be in charge of utilizing the rest of the algorithms, together with developing new ones[2]). More than half of assets are always managed by the in-house trading team of Haru Invest, although the proportion of the assets might fluctuate from time to time[9]. Numerically, roughly about 100 billion KRW* can be operated within the in-house system trading team (Editor’s note: ~$80 million as of February 2023 KRW to USD exchange rates. If it is true that Haru Invest trading team always manages at least 50% of the capital and the rest by partners, the capacity for total AUM should be at least ~$160 million. This number is in line with current theoretical approximations of Haru Invest AUM being at most $83.25 million during July 2021[2] — about the same time when the number was provided in an interview with the CEO[2]).

ℹ️ Global partners

One of the reason why Haru Invest works global trading partners is that firm can attain a lot of know-how throughout the mutual interactions, thus advancing the algorithms of both sides[31].

Haru Invest has stated that all partners go through multiple tests and need to satisfy extremely tough criteria such as organizational structure, trading capabilities, handling of different market scenarios and etc[12]. Moreover, in their complying process there are multiple checking points which are monitored on weekly and monthly basis[12].

When it comes to the so called “Global partners”, the official information in the website states “Haru Invest has partnered with 10 global asset management firms that implement a low-risk portfolio strategy that allocates assets to diverse categories”[7], however recent information states the partners are “more than 10”[9]. Also, trading is carried out on crypto derivative platforms which can handle more than 1 billion in trade volume daily[29](Editor’s note: Here is a list of all crypto derivative exchanges ranked by volume[105]). The big size of the capital being handled entitles Haru Invest to VIP tiers at the crypto derivative platforms they use, and lets them enjoy reduced fees, thus further improving the yield of their trades[2].

ℹ️ Exchanges and wallets used by Haru Invest

The company has a rigid structure of limited access control, as no single entity (not even the CEO[12]) has a full control over all transfers (Editor’s note: Which are mostly automated but not entirely[12]) or assets allocations.

All assets on our platform are transacted via the enterprise crypto asset management firm BitGo, which is trusted by over 700 institutions in more than 50 countries across the world[59]. Hugo Lee has revealed that all deposits by investors go straight into BitGo cold wallets within 10 minutes, which is a plus point for the security of the platform against hacks[29].

After each deposit is verified, Haru Invest utilizes 4 secure BitGo wallets which act as “coordinators” to deploy them to different cryptocurrency exchanges[2]. Particularly for “derivative exchanges” it was confirmed that Haru Invest works with about 10 platforms[12]. Some of the exchanges on which the firm has been identified to trade are Bitmex[9], Binance Futures[2][9], FTX[2][9] (Editor’s note: Haru Invest has successfully withdrawn all funds from FTX prior the halt of transactions[2][94]), OKEX[2][9], GOPAX[2], Bybit[9], Huobi Futures[2][9] and Coinbase[2]. The platform does not utilize any decentralized crypto exchanges[112].

After FTX collapse, Haru Invest has reduced the amount of cryptocurrency exchanges on which its teams and partners are allowed to trade, by limiting the pool only to 3–5 proof of reserve exchanges, which are safe enough[10] (Editor’s note: It can inferred that since the amount of exchanges where the capital is traded is reduced while the AUM remains the same, therefore the absolute amount of assets per exchange which Haru Invest has increased, resulting in a reduced diversification[2]).

The CEO of Haru Invest has also revealed the firm uses derivative platforms that handle more than 1 billion in trade value daily, with the reasoning being that such platforms would likely make a lot of profits from the trading fees alone and by extension should be relatively less risky[29].

Risks of the strategies of Haru Invest